Who doesn’t love a good bargain? As consumers, it’s easy to get drawn into the notion of opportunistically snapping up goods and services when their prices go down. I will admit to checking out the “best deals” on Amazon Prime Day or being tempted by the enticing ads for “blow out sales” that land in my inbox, especially around a holiday weekend. And while I’m not one to stock up on items just because they’re on sale, I know plenty of people who can’t resist the opportunity to scoop up items at a great price. But just because something is cheap doesn’t necessarily make it a good purchase. Almost all of us have probably made a few impulse buys because we felt like we were getting a great deal, only to realize that the quality wasn’t up to par, or that we didn’t really need or want it in the first place.

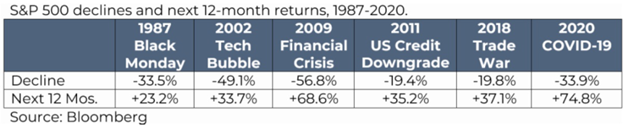

Unless you’ve been hiding under a rock or avoiding all forms of news, you know the markets have been volatile lately. We often remind our clients about the importance of asset allocation and diversification, especially during periods of market stress. As investors, we know that historically, market participants have been rewarded by staying the course and focusing on time IN the market as opposed to trying to TIME the market. As humans though, no matter how many times we hear this, when volatility strikes, we feel the urge to take action, sometimes to our financial detriment. When the stock market takes a tumble, uncertainty rears its ugly head, and it can be tempting to run for the hills and abandon the basic tenet of investing; buy low and sell high.

Here at Becker Capital, when the equity markets go “on sale”, we look for compelling opportunities to add new companies to portfolios. This is the time for our team of analysts to roll up their sleeves, dig in and identify good companies trading at attractive prices. How do we go about finding these companies? In this blog post, I’m taking our readers behind the scenes to get a glimpse into our internal process of identifying suitable assets to buy at attractive prices. For brevity’s sake, I’m going to focus only on identification of publicly traded equity investments.

At Becker Capital, our research team brings nearly three decades of industry expertise to the table. They employ a collaborative approach that combines thorough fundamental analysis with a detailed due diligence process. To generate new ideas, our analysts use a variety of sources to uncover stocks worth consideration. If a company shows potential to fit into our investment schematic, it’s added to the “Monitor List” to be scrutinized. This kicks off the process for the research analyst to do a deep dive as they work to understand the company inside and out—its business model, industry positioning, leadership, financial dynamics and management capabilities. Financial statements undergo thorough scrutiny, with special attention to measures of quality and cash flow durability. The team then compares those measurements to market prices to consider valuation closely. It’s a deliberate process designed to identify companies that meet our strict quality and valuation standards. After all, while we like a good bargain, a cheap stock isn’t necessarily a good stock based on that one metric.

After this process, if an analyst believes the idea is actionable, they write up a detailed investment thesis outlining their case. This is distributed to the entire investment team for review so they can become familiar with the specifics of the stock prior to holding a formal team meeting. At this meeting, the analyst presents their thesis, and the team has a chance to opine and ask questions. Upon discussion of the stock followed by a democratic team vote, one of three outcomes occurs: 1) the stock is added to the “Buy List”, 2) the analyst is asked to provide specific additional information, or 3) the idea is rejected.

Now let’s assume that the stock presented gets approved by the investment team and is added to the firm’s “shopping” (buy) list. How does it subsequently get into your investment portfolio? The next step involves our portfolio construction process where we focus on optimizing the balance of potential return with an appropriate level of risk, tailored to each client’s objectives and constraints to achieve specific investment goals.

Portfolio construction begins with asset allocation, or the targeted mix of stocks, bonds, alternatives and cash that we have previously determined, based on your needs. If we are considering the addition of a new stock to the portfolio and your equity bucket is already at your stated target, we evaluate trimming or selling existing stocks to make room for the new security. Potential tax implications are also taken into consideration during this process. We also look at current diversification to ensure we’re allocating stocks to different sectors, industries and geographies while taking your risk tolerance into account to ensure the stock under consideration is aligned with portfolio goals and appetite for risk. Once we’ve determined the stock is aligned with your investment goals, it is added to the portfolio.

Environments like these, while uncomfortable at times, can provide enticing opportunities for patient investors. Since the inception of our firm in 1976, we have followed a consistent investment philosophy and process through many market cycles, and this time is no exception. Behind the scenes, the Becker investment team is hard at work seeking out durable franchises at attractive (not just cheap) prices, that are able to weather the storm. We aren’t chasing bargains simply because they look inexpensive. Instead, we’re prioritizing companies that have built strong, sustainable competitive advantages and look attractive relative to inherent value and long-term potential.