Off and on over the years I’ve wanted to learn to speak a second language. Between high school Spanish and Duolingo, I have mastered asking where the restroom is and telling you that my bicycle is red. Finance is its own foreign language (although admittedly less useful on vacation). Just as you begin to look forward to retirement, you are forced to learn this new complicated way of communicating. Like a foreign language, it’s easier to become fluent if you speak it every day which is where I and other members of the Becker team come in to act as interpreters.

We should all become comfortable speaking conversational retirement finance. My goal with this blog is to educate you about Qualified Charitable Distributions but first, we must start with the ABCs of retirement finance… or more accurately, the IRAs (Individual Retirement Accounts).

There are many types of IRAs, but we will stick to high-level details in this Retirement 101 class. At its core, an IRA is a tax-advantaged savings plan designed to help individuals save for retirement. Once you reach a certain age (72, 73 or 75 depending on your birth year) you are required to start taking annual minimum distributions from your pre-tax retirement savings. These are known as Required Minimum Distributions (RMDs), which are mandated by the Internal Revenue Service to allow for taxation of those funds.

Keeping things simple again, for purposes of this blog I am assuming that the IRA funds in question are comprised only of pre-tax dollars. Meaning that you deferred income taxes when saving these funds for retirement, but you must pay taxes when funds are withdrawn. Any distributions, required or voluntary, will be taxed at your ordinary income rates. Depending on the account balance, a required distribution may be a large sum and is taxed at your highest possible tax rate. If you are charitably inclined, a Qualified Charitable Donation (QCD) is an enticing way to lower the taxable income you are receiving from RMDs.

A QCD is a direct transfer of cash from an IRA account to a qualified charity. Donors can begin utilizing QCDs at age 70 ½ and may gift up to $108,000 in 2025 (adjusted annually for inflation). The gift must go directly to a 501(c)(3) organization – it cannot go to a Donor Advised Fund or private foundation.

There are two significant benefits to a QCD: 1) the donation is not counted as income for tax purposes and 2) it does count towards the donor’s annual RMD. To see this powerful tool in action, let’s look at a case study.

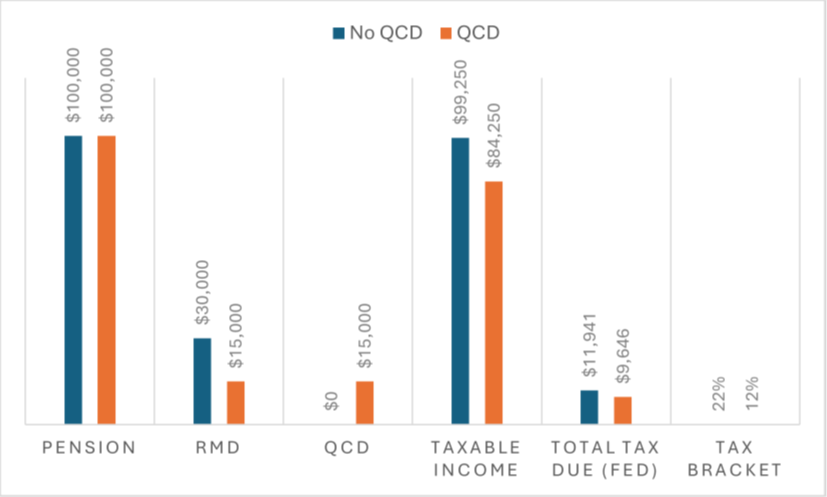

Case Study: Qualified Charitable Distribution

- Fred has recently retired from his job as a bronto-crane operator. He retired later than his wife, Wilma, would have liked and now needs to begin his RMD.

- Fred also has a pension that pays $100,000/yr and Wilma is worried about the RMD, $30,000 in 2024, moving them into a higher tax bracket.

- Fred and Wilma decide to give $15,000 to charity via QCD and are taking the standard tax deduction.

- By donating via QCD, Fred and Wilma lower their taxable income and stay in the 12% tax bracket*.

*Tax calculations based on 2024 tax brackets.

Your taxable income determines not only the amount you owe to the government, but eligibility for tax credits or deductions as well. It can also impact the amount of your Social Security that is taxable in addition to your Part B Medicare premium. Decreasing your taxable income via a QCD is an incredibly powerful tool for those who are charitably inclined.

As noted throughout this blog, scenarios have been kept as simple as possible, and your reality is likely to look different than the example included here. I encourage you to reach out to your Becker team to continue your lessons in conversational retirement finance and to see if QCDs may be a good strategy for you.