In the early 1960s, journalist Eric Sevareid observed that, “the biggest big business in America is not steel, automobiles, or television. It is the manufacture, refinement and distribution of anxiety.” This is certainly true today, as we face a deluge of opinions, facts and “facts”. It is increasingly stressful to comprehend and navigate the world – and the stock market! Do stocks, as Efficient Market Theory pundits believe, accurately reflect all information available at any given moment? Or does market volatility, particularly notable in the last year, at times seem like collective irrationality, gyrating based on immediate emotional responses to the news of the day?

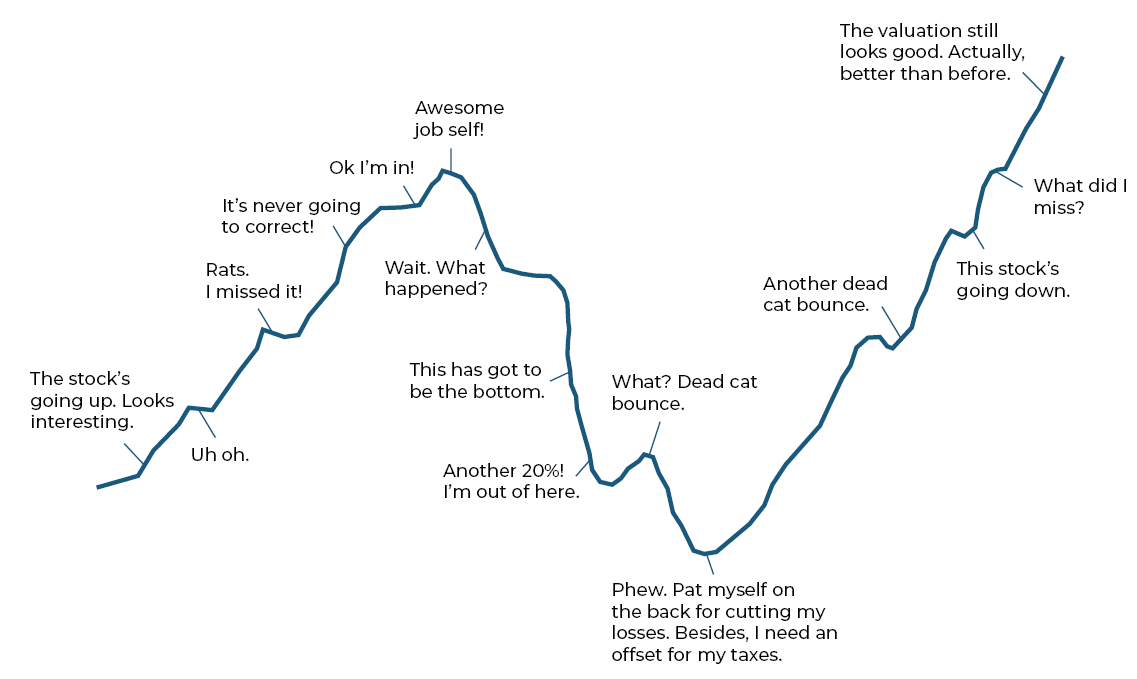

Behavioral finance is a relatively new field of study that combines psychological theory with conventional economics. It explores how both wealth and peace of mind can be enhanced by a better understanding of our emotions and biases. Investment behavior is estimated to drive over 80% of investment decisions and performance. Thus, it is critical to step back from our fight or flight response centers. Seek objective advice on building and executing a diversified asset allocation that reflects your values, risk tolerance and the time frame estimated to achieve your goals. Volatility is normal but disconcerting; it can cause investors to lose their nerve and abandon their strategy during market dislocations.

It is worth exploring the tendencies that can influence us to work against our own best interests. Below are several of the most common behavioral investment mistakes.

· Confirmation bias: people tend to seek out and give greater credence to information that corroborates their personal beliefs, while ignoring data that contradicts their opinions.

· Loss aversion: psychologists estimate that people feel the pain of loss two times as strongly as they enjoy a successful outcome. Fear can contribute to emotional and impulsive decisions.

· Overconfidence: individuals frequently overestimate their skills, intellect or talent. The structural framework of a sound financial plan can temper this tendency.

Our advice? Take the emotion out of investing. Work with professionals to assess your financial needs and your tolerance for rocky markets. Don’t check your accounts daily. Dollar cost average and minimize your debt. And keep in mind that the stock market (as measured by the S&P 500) has fallen more than 10% only eleven calendar years in the last century. It is the compounding of returns that creates wealth. Keep calm and carry on!