Global trade has been the subject of much debate in recent times. The meteoric rise of China, its widening trade deficit with the United States (U.S.) and the loss of manufacturing jobs in the U.S. has kept the globalization discussion front and center. Lately, a seemingly tougher stance on free trade by America has contributed materially to volatility in the stock market. In this piece, we focus on the U.S.’s trade relationship with China, its biggest trading partner.

Cross-cultural and cross-border trade has been a hallmark of human history dating back thousands of years. Indeed, an independent America’s prosperity too was founded in global trade, with China playing a key role in the early days. The American Revolution had severely impaired trading relationships with Great Britain (and its colonies) and other European nations were simultaneously mounting protectionist policies. China – a buyer of silver, ginseng, animal furs and a seller of porcelain, silk, nankeen and tea; all of which could only be traded via the monopolistic British East India Company previously – represented a compelling opportunity for the nascent country. The Empress of China, an American vessel, set sail from New York in 1784, the year after the Treaty of Paris was signed, setting the stage for a tumultuous but enduring trade relationship with China.

Since, global trade has flourished, notably post World War II when an organized framework for trade emerged with the General Agreement on Tariffs and Trade (GATT) in 1947 and ultimately the formation of the World Trade Organization (WTO) in 1995. Capital flows surged and new innovations blurred traditional boundaries, enabling a swift relocation of the origin of goods and services to places best positioned to deliver them. Advances in transportation further reduced the value of proximity to the end-buyer; the Empress of China took 14 months and 24 days for its round trip from New York to China, 14 months more than it now takes. Apple’s iPhone – an icon of American innovation – relies heavily on hundreds of vendors across tens of countries, demonstrating the globalized nature of business today. A pending buyout transaction further illustrates the interconnectedness of trade: Qualcomm, a U.S. company, needs Chinese approval (among others) to complete its acquisition of NXP Semiconductors, Inc., a Netherlands company.

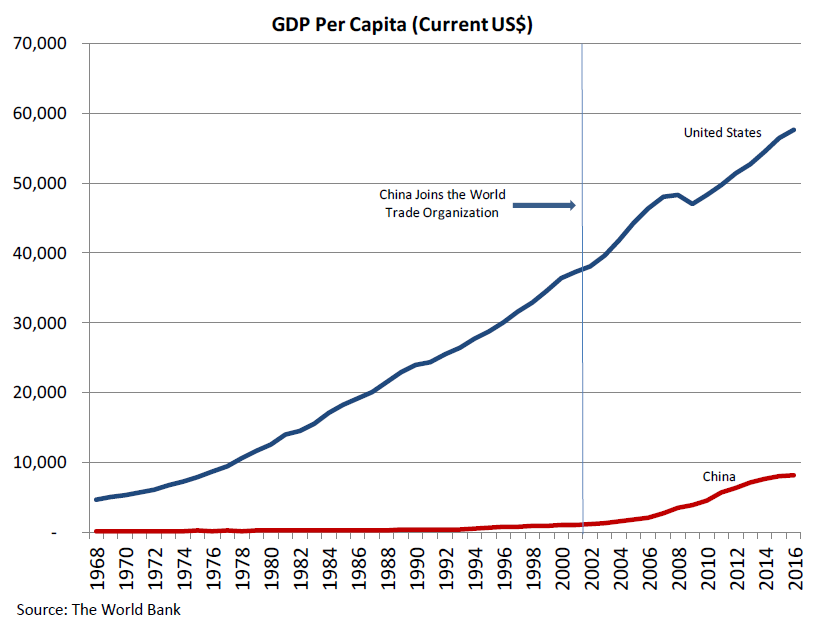

For its part, China leveraged its massive low-cost labor force while regulating its currency to become a leader in manufacturing. A significant expansion of China’s middle class followed – from 5 million households in 2000 to 225 million in 2016, creating an enormous market for U.S. made goods and services. Concurrently, America’s consumption oriented economy led to a widening trade deficit with China – to the tune of $375 billion in 2017. The deficit, while potentially overstated given the complexity of the global supply chain, combined with a loss of U.S. manufacturing jobs (12.5 million today vs. 18 million in 1990) has been a constant source of consternation among U.S. workers and politicians.

China’s rising economic prowess has also allowed it to exert increasing influence on foreign companies eager to access its large domestic market. Multinational companies are often faced with bureaucratic licensing practices, technology transfer obligations and domestic manufacturing requirements. In fact, companies have routinely noted China’s neglect of technology theft and its unwillingness to enforce intellectual property (IP) rights amid widespread piracy, patent infringement and counterfeiting. Studies suggest that such lack of enforcement costs U.S. companies hundreds of billions of dollars annually. Other actions, like alleged state-led cyber-attacks and its 2009 slashing of export quotas for vital rare earth materials (China then produced over 95% of them), have also contributed to unease over China’s emergence.

As of this writing, trade-related tensions are high. The U.S.’s imposition of tariffs on steel, aluminum and over $50 billion of Chinese manufactured products has been met with an equally sized tariff on U.S. made products. But do punitive tariffs and the accompanying counter-tariffs benefit anyone?

Before delving into the implications of such actions, we note that global trade has indeed benefited Americans, even if unevenly so. GDP per capita has grown at a brisk pace for decades and the loss of manufacturing jobs has been more than made up by other sectors. Technological innovation has played a critical role in boosting productivity of U.S. workers allowing them to migrate to higher-paying value-added jobs. A glimpse of that can be seen in the quadrupling of U.S. manufacturing exports over the last 25 years and a multi-decade high in overall employment levels despite the previously mentioned decline in overall manufacturing jobs.

Returning to retaliatory trade measures, we observe that history is littered with examples. One such instance is the Embargo Act of 1807 imposed by President Jefferson in response to impressment(i) by the British Navy and confiscation of American ships and cargo by both the French and the British amidst the Napoleonic War. Aimed at crippling the British and French economies by cutting off trade, the embargo banned American ships from sailing to foreign ports and foreign ships from obtaining cargo at American ports. Counter to expectations, the embargo throttled the American economy as exports dropped precipitously, leading to an estimated 5% decline in the country’s gross national product (GNP) then. The embargo was revoked in 1809.

The modern era has also witnessed a multitude of protectionist measures, largely resulting in outcomes contrary to initial expectations. Implemented in the early stages of the Great Depression, the Smoot-Hawley Tariff Act of 1930 imposed tariffs on 20,000 imported goods. The Act and subsequent retaliatory measures from trading partners cut imports and exports by over half, exacerbating domestic economic conditions during the Depression. In 1934, Congress passed the Reciprocal Trade Agreements Act which allowed President Roosevelt to negotiate tariff reductions with trade partners. More recently, President Bush imposed tariffs on steel imports in 2002, which were ultimately withdrawn in 2003 after the WTO ruled them illegal. A study found that these tariffs led to a loss of 200,000 jobs in the U.S. Another unsuccessful attempt was President Obama’s imposition of tariffs on Chinese tire imports in 2009. While imports from China dropped, overall imports continued to rise as tires were sourced from other lower-cost countries.

China has for years promised to ramp enforcement of intellectual property rights and provide unencumbered access to its domestic market. But, it has rarely policed violations and remains a tightly controlled and highly regulated market. In our view, defending American intellectual property is paramount for its sustained global leadership – both economically and geopolitically. Thus, while trade standoffs are undesirable, as history strongly suggests, America’s current hardline stance on trade may be necessary as a siphoning away of technology knowhow may be just as detrimental over time. After all, risks remain that China’s much faster growing economy may potentially dilute the U.S.’s bargaining power as time goes by.

Ongoing trade spats complicate the equity market landscape. Loose monetary policy instituted in the wake of the financial crisis, a subsequent uptick in economic activity and, more recently, a significant tailwind from tax reform have supported a decade-long bull market. But tighter monetary policy is forthcoming and trade rhetoric is evolving into retaliatory measures. Plus, Federal deficits are set to rise implying the need for additional foreign capital – China is already the U.S.’s largest creditor today. All of this is happening at a time when U.S. corporations have taken on trillions of dollars in new debt to repurchase stock and at a time when the economy is essentially at full employment, suggesting higher wages or pressure on corporate margins on top of potentially higher interest expenses. In short, uncertainties are rising just as supportive factors are receding.❖

(i) Forcing men into military or naval force by compulsion