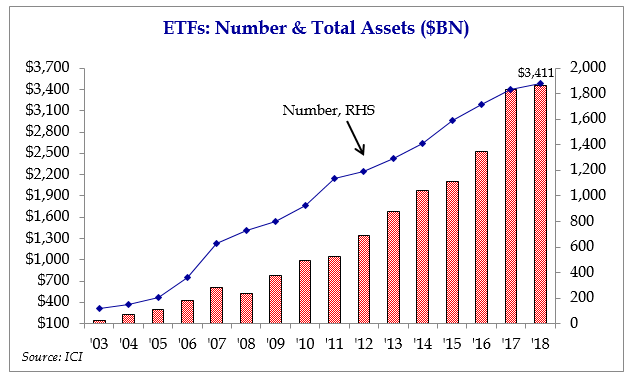

Exchange traded funds (ETFs) are relatively new investment vehicles, having grown exponentially since the financial crisis of 2008. A decade ago, there were 250 US based ETFs with assets of $400 billion (twenty years ago they were virtually non-existent). Today there are 1900 US ETFs representing more than $3.4 trillion of invested assets (as shown in Figure 1). Investors have plowed money into these low cost, relatively tax efficient securities that look like mutual funds but trade like stocks. In fact, Credit Suisse noted they have grown so popular, that last year 14 of the 15 most actively traded securities were ETFs rather than individual stocks such as Apple, Facebook or Google. A recent Charles Schwab study indicates millennials are dumping their individual stocks and embracing ETF investments as their “investment vehicle of choice”. Currently, ETFs represent only 11% of the $30 trillion equity market (as measured by the capitalization of the Russell 3000) and are still dwarfed by their $16 trillion older cousin – mutual funds. Trading volume in these securities now comprise nearly 30% of total market trading volume; ETF volumes rose 50% last year (vs. 7% for stocks) and are accelerating in 2018 as ETF market share grows.

Figure 1 (Source: Strategas Research Partners, data through 4/30/2018)

The nearly decade long bull market has fueled ETF popularity as investors have increasingly favored these instruments to provide diversification, flexibility and liquidity. The presumption is these attributes, combined with low relative cost, render ETFs less risky than other securities. In fact, sponsors like Vanguard explicitly state ETFs are safer than individual stocks. But is this true? Are their claims potentially understating the complexities of this burgeoning market that has not yet been tested in size in a bear market? Or are these securities truly just tracking products that will mimic the upside, and the downside, of broad markets? There have been instances in the last thirty years of financial instruments, created in bull markets by supposed Wall Street geniuses (and algorithms), that have not performed as intended in liquidity crises – portfolio insurance (1987), junk bonds (1989), bond derivatives (1994), hedge fund strategies (1998), and mortgage backed securities/collateralized debt obligations (2008). Given historical precedent, any financial instrument that has grown rapidly in a short period of time is worthy of examination.

First let’s define exchange traded funds. In simplest terms, ETFs are “baskets” of securities that typically track a specific market segment or index. These are termed “passive” securities – the majority are designed to replicate their benchmark’s performance, not outperform it. One can buy ETFs that are proxies for virtually any asset class - broad market, sector, geographic region, commodity or niche. The average investor with modest capital has a wide range of options to create, at a lower cost and with fewer tax consequences than a mutual fund, an individualized portfolio with as much diversification, or concentration, in the strategies of their choice.

To understand ETFs, it is important to appreciate how they are created and redeemed; this process allows individuals to buy and sell ETFs just as they would stocks. Investors do not invest cash directly in ETFs, nor do ETFs own the underlying securities directly. The process is as follows:

- An ETF sponsor files with the Securities and Exchange Commission to create a specific ETF. Once approved, the sponsor contracts with “authorized participants” (AP), or large broker/dealers and banks, who, due to their sizeable buying capacity, are empowered to create ETF shares. Goldman Sachs, Morgan Stanley, Citigroup, Merrill Lynch/Bank of America and JP Morgan are a few of the dominant APs.

- It’s the APs job to acquire the securities the ETF wants to hold. For example, an AP tasked with designing an ETF to track the S&P500, will buy the underlying shares at the exact weights in the index. It will then deliver those shares to an entity like State Street (SPDRs). In exchange, State Street gives the AP a block of equally valued ETF shares, called “creation units” – bundles of typically 50,000 shares efficiently assembled by computers. Bundling these shares allows for greater trading efficiency and lower costs by trading larger blocks of securities. And this relationship allows for “in kind” transactions which minimizes trading gains by delivering shares of the ETF, as opposed to each of the underlying securities.

- APs serve yet another critical function. Because ETFs trade throughout the day, there can be a mismatch between flows in and out of ETFs and the value of their assets. Let’s say investors flock to an energy ETF like the popular XLE, anticipating a rapid increase in oil prices. The value of the ETF on an intraday basis could rise above the value of the underlying securities. When this happens, APs intervene by selling shares of the ETFs on the open market. Conversely, if flows out of an ETF create a discount to its assets, the AP will buy the undervalued shares. The APs make small spreads on this arbitrage process; they also keep ETF’s net asset values (NAV) aligned with the value of their holdings on a nearly real time basis, thereby minimizing what is called tracking error (the difference between the performance of the ETF and the performance of the individual holdings). Because multiple APs monitor most ETFs, there is generally ample liquidity to facilitate the intended arbitrage.

The bull market did not spawn ETF products but it has created a propitious environment for them to thrive. In fact, they have become so popular that frequently the trading volume in a given ETF exceeds the daily volume of its most liquid constituents. This phenomenon leads us to ask, could ETF inflows and outflows in volatile markets exacerbate the volatility of its assets, and concurrently the broad market? Imagine an event that causes oil prices to plunge. Investors rush to sell oil related securities. Perhaps they sell short energy ETFs or employ derivatives that enable them to bet against the price of crude. In theory, APs would step in to arbitrage the tracking error of the ETF and its components away. But the immediacy and magnitude of such a crisis could create a liquidity void that could feed upon itself, not completely unlike the cascade of selling exacerbated by portfolio insurance on Black Monday in 1987.

Let’s look at this scenario on a more granular level. Exxon Mobil is one of the world’s largest integrated oil companies. The stock is a sizeable holding in more than 120 ETFs. It is 22% of the XLE, 20% of the VDE and 13% of the IXC. It is also widely owned in ETFs that emphasize dividends, value, mega cap, low beta, global and defensive. It seems logical to assume that large and abrupt outflows in energy ETFs could spill over to a wide range of investment strategies and products. There have been few stressors in this nine year bull market. But we can speculate that the implied liquidity of these securities – an estimation of trading volume in an individual ETF based on the liquidity of its underlying assets – is potentially very different than average daily trading volume or how the security has traded in the past. This mismatch could create a liquidity “black hole”, possibly magnified by leverage or derivatives which have grown in lockstep with investor complacency in the market’s strong trajectory and record low volatility. There have been only a handful of ETF glitches in the last decade. A brief analysis could shed a bit of light on market functionality. In 2012, Knight Trading experienced a technical error; its ability to create or redeem ETF shares was impaired. Other APs stepped in quickly to fill the gap. In 2013, Citigroup temporarily ceased transmitting redemption orders for a number of ETFs that held foreign securities. Again, other APs interceded.

The Flash Crash on August 24, 2014 was more problematic. Investors were concerned about economic weakness in China and rising interest rates in the US. This set the stage for program selling before the market’s open. In the first five minutes of trading that Monday morning, the Dow dropped 1,100 points and only half the stocks on the NYSE were able to open as bid/ask spreads gapped. There were 765 stocks in the Russell 3000 that were down more than 10%. There were nearly 1,300 trading halts for 471 different stocks and ETFs. Because of this, it was not possible to calculate the value of many ETFs; arbitrageurs had trouble estimating ETF NAVs and were thus unable to establish accurate bid/ask spreads. Circuit breakers, which halt trading in securities for five minutes when they move more than 10% in fifteen minutes, worked well. The market calmed during the course of the trading day and recovered much of the loss. However the Flash Crash evidenced the havoc that could result from “price insensitive” programs that reflect money flows, not valuation.

Do ETFs track or lead moves in their underlying assets? Could these instruments increase the volatility of individual stocks and the market as a whole? Do ETFs increase stock correlations, either in their sectors or in broader markets? These are questions that are unanswerable today. The unintended consequences of Wall Street’s latest and greatest financial inventions are potentially significant. Liquidity is a coward – it only exists when you don’t need it. To quote Mark Twain, “history does not repeat itself, but it often rhymes”. We don’t know how ETFs will behave in severe market turmoil; but beware the promises of plentiful liquidity.❖