In recent remarks, Federal Reserve Chairman Powell listed the well-known positives that have characterized some of the latest economic data, while highlighting the stark contrast of the current environment with the financial maelstrom that engulfed the economy a decade ago. Certainly, there has been no shortage of retrospectives of the problems that beset the economy and markets in 2008, with most noting how much things have improved in the intervening years. Nevertheless, now that we are in the 10th year of this economic expansion and bull market, we believe it is useful for investors to pause and take the measure of the current situation.

As 2018 got underway, in the midst of a widespread belief that we were in a synchronized global economic expansion, there was much talk in the media and professional investment circles of an impending market “melt-up” that would send stock prices soaring. Nevertheless, after peaking in late January, stock prices declined dramatically, initially for technical reasons related to a popular investment strategy tied to market volatility. But as is often the case, the market narrative followed prices lower, with stories in the financial press expressing concerns over a weaker U.S. dollar, further interest rate hikes by the Federal Reserve, the inflationary potential of accelerating wages, and the end of a long period of market tranquility. Add to that the policy twists and turns of a mercurial administration together with the appointment of a new Federal Reserve Bank Chairman, and the forecast of weaker, more volatile markets made sense. From the January 26th high, the S&P 500 index fell 11%, a decline euphemistically referred to as a “healthy correction”.

Fundamentals, however, told a different story. With tax cuts benefiting both individuals and corporations, overseas corporate cash being repatriated, strong corporate profits and increased merger & acquisition activity, share prices did not stay down for long. Even the prospect of broad tariffs and trade restrictions had the effect of temporarily boosting economic activity as buyers accelerated their purchases of foreign goods to get ahead of the expected higher prices imposed by the tariffs. By late in the 3rd quarter, the equity markets were back to their old highs and real (inflation adjusted) economic growth was tracking above 4% annually. Despite already being one of the longest economic expansions on record (if not the most robust), Wall Street strategists and economists began suggesting that it could continue for considerably longer. And it very well could.

In fact, it is precisely at such times, when economic growth is solid, financial stresses are low, and consumer and business confidence is high that we should challenge some of the underlying assumptions that have been driving markets.

As we have noted in prior communications, one of the major bright spots, and a significant driver of this long bull market, has been the dramatic rise in corporate profitability and earnings per share. Overall business activity is well above the lows of 2009, while wage and salary gains have been largely kept in check, the result of increased competition at home and abroad. Restrained commodity and energy costs have also helped boost profitability. More recently, changes to the tax laws have brought corporate tax rates down to 21% from 35%, providing a substantial boost to after-tax earnings. And other changes to the tax code allowed for billions of dollars held by companies overseas to be repatriated at low expense. As a consequence, profits rebounded strongly coming out of the Great Recession and have been maintained at historically high levels since then. The result can be seen in the top panel of the adjacent chart which shows corporate profits as a share of GDP over the decades.

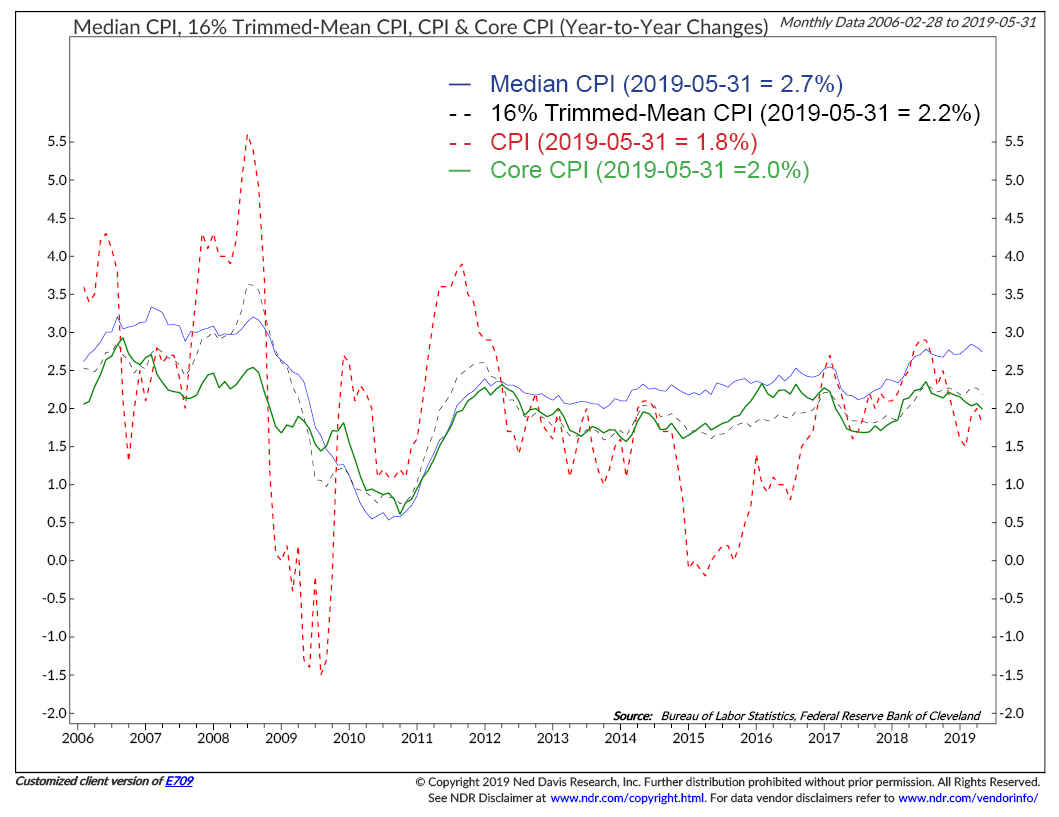

The lower panel, which displays wages and salaries as a percentage of the economy, further illustrates that some meaningful portion of the profit improvement came from a long decline in workers’ incomes relative to the overall economy. While productivity gains undoubtedly played a role in this trend, most economists would agree that overall worker compensation has not kept pace with corporate profitability, as the chart certainly indicates. More recently, however, declines in overall wages and salaries appear to have stabilized and begun to improve. With the unemployment rate at a low 3.7%, employees are in a much better position to ask for, and receive, higher compensation. Moreover, labor turnover has increased markedly in recent quarters as employees have been willing to switch jobs for higher pay and benefits. Higher minimum wage laws have also played into this trend. From a societal standpoint, much of this is a welcome and long overdue development. For investors, however, it represents a regime change to the experience of the last several decades. Without commensurate gains in worker productivity, increased wages and salaries will come at the expense of corporate profit margins and/or higher inflation. What had been tailwinds for investors for many years are rapidly becoming headwinds, requiring significant efforts and investments on the part of many companies if they are to maintain their high levels of profitability.

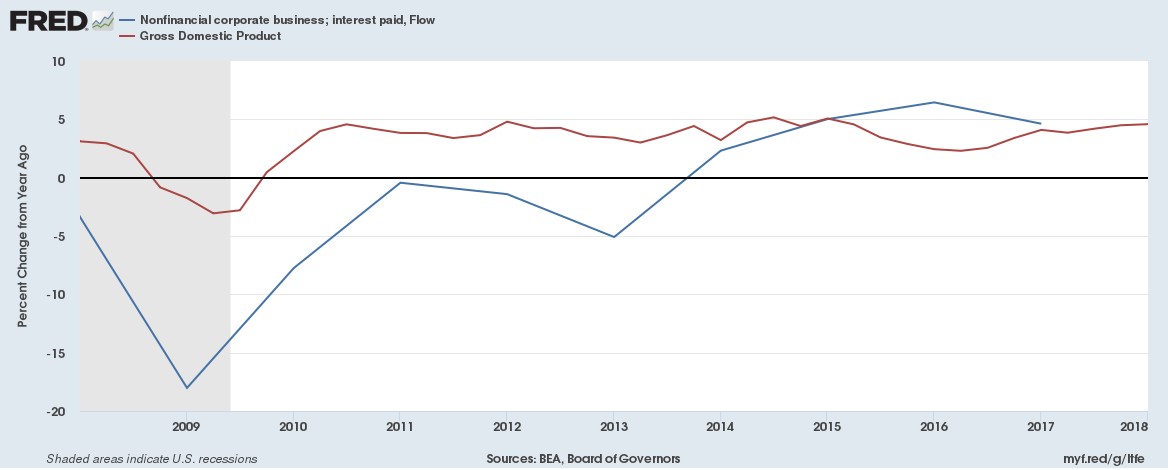

Higher wages and salaries don’t represent the only threat to corporate profitability. The chart below, courtesy of the Federal Reserve and the Bureau of Economic Analysis, plots the annual rates of change for corporate interest expense against annual percentage changes in the economy as measured by GDP. As can be seen, interest expense fell in the early years of the past decade before starting to rise. Certainly, part of this decline was the natural result of corporate aversion to debt in the immediate aftermath of the recession. But part of it was also the result of the Federal Reserve’s aggressive policy of easy money and low interest rates which held financing costs to very low levels even as the economy grew and corporate debt levels swelled. Ned Davis Research estimates that non-financial corporate debt rose from 39.7% of GDP in 2010 to 46.2% at June 30th, 2018. The average level over the past six decades has been about 35%.

More recently, though, interest rates have been on the rise. The generous tax cuts for businesses and some individuals, which certainly helped corporate profits and global competitiveness, were not funded out of spending cuts, but with what will prove to be sizable deficits that will have to be funded in the capital markets. From a low of 1.36% in July of 2016, the interest rate on 10-Year U.S. Treasury Notes climbed to a recent 3.20%, an increase of 135%. While still low by the standards of the last 30 years, they come at an awkward time when overall debt levels are high and growing. We haven’t heard much discussion of the “crowding out” phenomenon whereby government borrowing overwhelms that of corporations and other borrowers, but it would not come as a complete surprise. We are in a unique period where the Administration forecasts the Federal budget deficit for 2019 to be in the range of 4% to 5% of GDP, amounting to some $1 trillion, and growing faster than the underlying economy. It is reasonable to ask who is going to buy all of that additional debt and what interest rate will they demand.

None of this is to suggest a collapse in corporate profitability or that the economy will lapse back into recession anytime soon. As noted earlier, underlying economic fundamentals remain solid. Investors should, however, be alert to the idea that the best news in terms of corporate margins and profit growth is largely in the rear-view mirror.❖