I learned a new joke in honor of St. Patrick’s Day. It goes like this: two Irishmen and a Welshman head to a bar in the Republic of Ireland. Trust me; the punchline is great but depends on which path the United Kingdom takes in the Brexit process (set to occur formally on March 29th). Both paths result in two of the pint-seeking triumvirate being held up at newly instituted checkpoints somewhere in Northern Ireland and the Northern Irishman on the hook for the tab. And like in all good bar jokes, the trusty bartender is the star of the show. All jokes aside and as we enjoy the welcome bounce in the major equity indices thus far in 2019, our radar is constantly scanning for any possible speedbumps on the horizon. Brexit, or the United Kingdom’s formal exit from the European Union that is set to occur on March 29th, presents one of these potential speedbumps.

To date, Brexit has been as confusing and politically charged as many feared. As of this writing, British Prime Minister Theresa May’s 585 page draft agreement with the European Commission had suffered the worst defeat in the U.K. House of Commons in history when it was presented for approval. The primary objection from the House of Commons is seeded in deep and non-financial history. Specifically the issue of reinstituting a hard border between Northern Ireland and the Republic of Ireland (or a new border between Northern Ireland and the rest of the U.K. under the “Backstop” provision) is causing justifiable concern. Since we view the issue through a commercial lens however, we are left to assess what impacts potential outcomes could have on the U.K. economy, in addition to those the existing confusion already has. Moreover, what spillover impacts could affect the interconnected global marketplace?

Without Parliament’s approval, the U.K. will enter the Brexit process under the coined “No Deal” scenario. Under this scenario, World Trade Organization (WTO) rules are set to engage overnight. While orderly sounding, the ramifications of such a sudden change could be significant. Take for example, the 50,000+ delivery trucks that get on the continental Europe-bound ferries at the Port of Dover each day. Currently, there are no customs inspections of, or duties imposed on the lorries getting onto the boat. If WTO rules are imposed however, each one of these trucks is required to be inspected and any applicable duties collected upon exit. This single change could take wait times (assuming inspection time of 70 seconds per vehicle) from a few hours currently to 6 days! So much for “fresh” fruit.

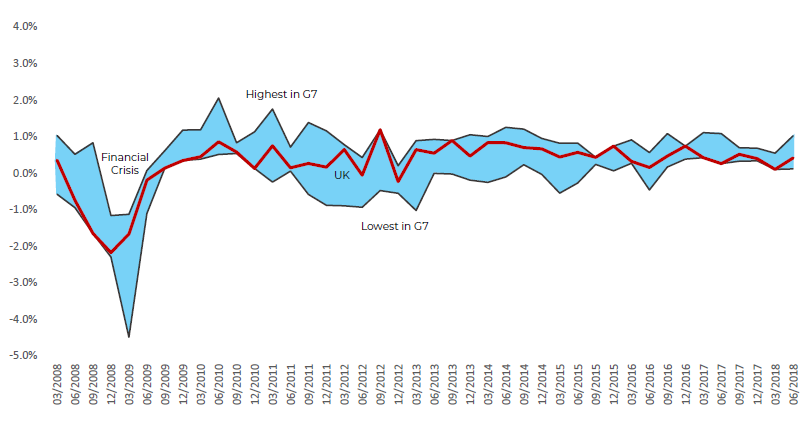

The U.K. government estimates that the No Deal scenario would cause a 9.3% contraction in annual gross domestic product versus the draft agreement version of Brexit which the government estimates would cause a 3.9% contraction. For what it’s worth, the government could call for a second referendum to give the U.K. the opportunity to stay in the EU, a move the European Court of Justice all but welcomed in December. It would take more than 5 months to assemble the vote and there are only 4 weeks until the leave process automatically takes place however. Not to mention the confusion about what options could be presented in such a referendum.

What does it mean for equity markets? That’s the thing with breaking up newly formed organizations – we really don’t know. Perhaps European Commission President Jean-Claude Juncker put it best when he claimed that the process is “in God’s hands.” Best case scenario is that market forces keep the wheels of commerce and government relations turning until formal agreement is approved by the U.K. government. Worst case is those wheels grind to a halt until it happens. Our best guess is that the scenario plays out somewhere in the middle, with continued operation in most areas but a fair amount of confusion. Uncertainty is rarely embraced by financial markets, but Becker Capital’s emphasis on purchasing high quality assets that generate stable cash flows helps to provide a buffer if and when these periods occur.