Global financial markets have seen trillions of dollars in value being created or lost as developments (or tweets!) have unfolded on the trade front. A trade deal with China in early May unraveled as concessions demanded by the United States on business practices and intellectual property rights protections, among others, remained the points of friction. Previously announced tariff burdens from both sides have now taken hold and other non-tariff measures are being instituted. To compound matters for investors, the Trump administration has simultaneously escalated trade rhetoric against key allies – most recently against Mexico by slapping ratcheting tariffs on the basis of immigration concerns, while pushing Congress to ratify the United States-Mexico-Canada Agreement (USMCA).

These events have caught investors off-guard, sending markets into a tailspin that has lasted for a few weeks as of this writing. Champions of deregulation and free trade, investors have broadly cheered President Trump’s policies and have supported his resolve to upend unfair trade practices and defend American intellectual property. But what previously appeared to be a relatively straightforward spat on trade and business practices now appears to have evolved into a multi-dimensional dispute encompassing national security and foreign policy – an evolution investors probably did not expect.

China’s economic rise has been widely expected to put it on a collision path with the U.S. as China seeks to assert its rising influence in global affairs. Britain’s ex-prime minister Tony Blair said that “the rise of China is now a fact” and that “there is not a single issue in the world today…that can be solved without

superpowers require technology, strong economies and soft power influence to sustain themselves. “China understands that”.’

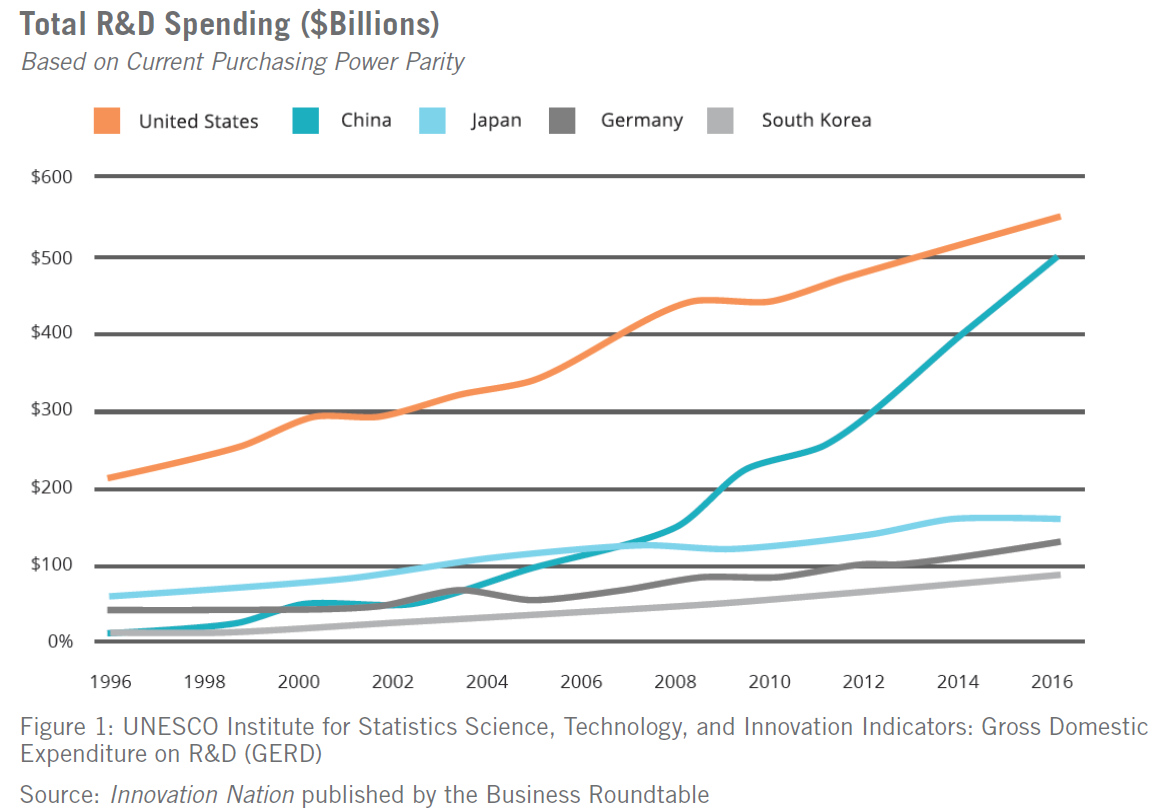

Traditionally seen as a fast follower (or a copycat), China in 2015 launched its “Made in China 2025” initiative – a blueprint for achieving technology self-sufficiency in key areas. While it is commonly assumed that China often acquires technology via nefarious means, including coercing companies to share intellectual property, their growing investment in research and development cannot be overlooked. Gross domestic expenditure on research and development as a percentage of GDP has more than tripled over the last 20 years, a time during which it has held largely flat in the U.S. China is now second only to America in aggregate research and development spending, exceeding that of Germany, Japan and South Korea combined (Figure 1).

China”. Indeed, China’s Belt & Road Initiative (BRI) is illustrative of its global ambitions. This initiative aims to create a modern Silk Road, improving regional economic cooperation and infrastructure connectivity amongst 68 countries with 65% of the world’s population and 40% of global gross domestic product.

But how successful China is in exerting global influence is ultimately a function of economic prowess, which in itself is unachievable without technology leadership. And therein lies the crux of the issues between the U.S. and China. America’s technology leadership has been a foundational element of its prosperity and its pivotal role in global economics and geopolitics. China too now seeks this advantage. David Shambaugh, Professor of Asian Studies, Political Science & International Affairs at George Washington University and author of several books on China suggested that ‘Beyond weapons, superpowers require technology, strong economies and soft power influence to sustain themselves. “China understands that”.’

Traditionally seen as a fast follower (or a copycat), China in 2015 launched its “Made in China 2025” initiative – a blueprint for achieving technology self-sufficiency in key areas. While it is commonly assumed that China often acquires technology via nefarious means, including coercing companies to share intellectual property, their growing investment in research and development cannot be overlooked. Gross domestic expenditure on research and development as a percentage of GDP has more than tripled over the last 20 years, a time during which it has held largely flat in the U.S. China is now second only to America in aggregate research and development spending, exceeding that of Germany, Japan and South Korea combined (Figure 1).

China is not just spending on technology advancements. It has significantly expanded access to science, technology, engineering and mathematics (STEM) education – over 1,800 new universities opened in China since 2001 (total of 2,914 in 2017), now producing nearly five million STEM graduates, 10-fold the number in the United States. Combined, these factors appear to be driving a substantial increase in new innovations. In 2017, China accounted for 20% of international patent filings, a close second to the United States share of 23%.

Next generation technologies like artificial Intelligence (AI) and the 5th generation of cellular technology (5G) are where the battle lines are being drawn. AI – the moniker for human-like intelligent behavior from machines – has the potential to bolster productivity and enable automation that would have seemed impossible just a few years ago. PwC predicts that AI will contribute over $15 trillion to the global economy by 2030 and pegs China as its single biggest beneficiary, topping the U.S. On the other hand, 5G promises data speeds up to 100-times current 4G speeds and will enable the next generation of game-changing technologies much like 4G did – ridesharing companies like Uber, proliferation of video services like Netflix, cloud-based services like iCloud, and many other services wouldn’t be possible without 4G data speeds and throughput.

Stakes are high considering the potential of these new technologies. Enter the Committee on Foreign Investment in the United States (CFIUS). Tasked with reviewing cross-border deals for national security implications, and awarded vastly expanded powers by the Foreign Investment Risk Review Modernization Act of 2017 (FIRRMA), CFIUS has already influenced cross-border M&A. Chinese acquisitions of U.S. firms fell 94.6% to $3 billion in 2018 from a record $55.3 billion in 2016. In a high profile intervention, CFIUS recommended blocking Broadcom’s (a Singapore-based company at the time) attempted hostile takeover of Qualcomm, the world leader in wireless technologies. The agency asserted that the takeover would weaken Qualcomm’s ability to invest in 5G and “leave an opening for China to expand its influence in the 5G standard-setting process”, posing national security risks. CFIUS also alluded to Broadcom’s relationships with “third party foreign entities” as a risk factor.

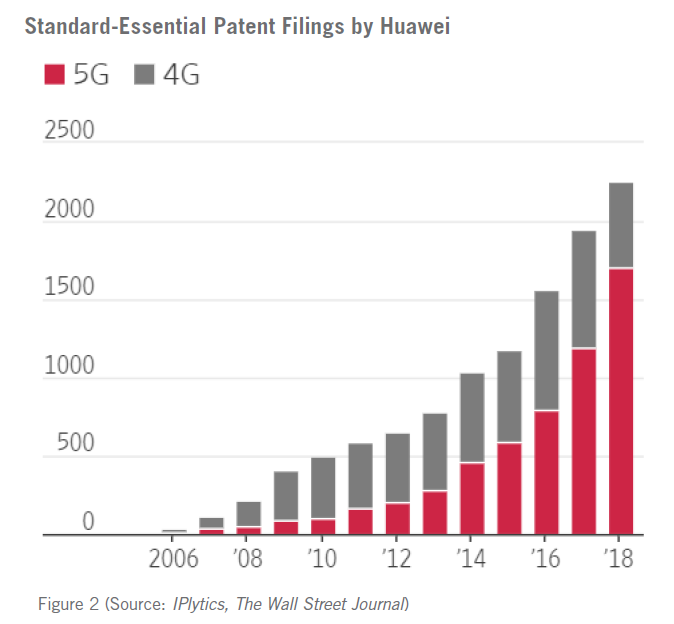

That brings us to Huawei, purportedly, that “third-party” and Chinese wireless behemoth that generated $107 billion in revenue in 2018 (up from $28 billion in 2009). In addition to being the world’s largest wireless network equipment provider and second largest maker of handsets, it is now the leading contributor of technical inputs and filer of patent applications for 5G globally. In a relatively short span of time, Huawei has propelled China’s presence in a key technology where it has historically had little to no presence. The country has effectively gone from having no role in setting the 2G standard, developing a China-only 3G standard, increasing participation in 4G to now potentially leading in 5G.

But Huawei, which has long been suspected of intellectual property theft and having close ties to the Chinese government, is also a posterchild for the geopolitics at hand. In recent months, Canada arrested the company’s chief financial officer at the request of U.S. authorities for violating U.S. sanctions on doing business with Iran. More recently, Huawei was placed on the United States’ “Entity List”, which requires sellers of goods and services to acquire a license before selling to entities on the list. Typically considered a death knell, Huawei’s addition to the list could indeed be debilitating as companies worldwide restrict business dealings with the company.

Only time will tell whether U.S. actions against Huawei are aimed at curtailing the company’s improper business practices, gaining an upper-hand in its trade negotiations with China, paralyzing China’s efforts to gain leadership in 5G, or all of the above. China’s discontent with U.S. actions is clear. It announced an investigation of American transportation giant FedEx for the mishandling of packages (related to Huawei!) and announced the creation of its own version of the U.S. Entity List.

We surmise that China has powerful advantages in its battle with the U.S., however. President Xi has garnered more clout in the Communist nation in recent years and is shielded from election cycles that are the cornerstone of democratic countries. And there is significant disagreement amongst American politicians (even within the Republican Party) on President Trump’s handling of this crisis. Secondly, China’s authoritarian-capitalistic model has worked successfully for decades. It has created a strong middle-class and some massive state-owned companies: 11 of the world’s 50 largest companies by revenue are Chinese; 10 of which are state-owned.

Furthermore, the model has also helped create a robust ecosystem of private enterprises that are leading China’s innovation efforts. The country now boasts the world’s largest mobile payments ecosystem led by Alipay, and is home to technology giants like Alibaba and Tencent and three of every ten “Unicorns” (or startups worth >$1 billion), including the two most valuable. The world’s highest-valued AI company, SenseTime – a leader in face recognition, is also Chinese. Speaking of face recognition, jaywalk in Shenzhen (a city of over 12 million residents), and you’ll get shame-listed on public displays, texted on your phone that you committed a crime and be fined – all automatically by the AI police. And the Xinhua State-run news agency now features artificial AI-powered news anchors. China also leads in other emerging technology areas like renewable power, where it is the world’s largest investor, and in electric vehicles – there are over 420,000 electric buses in China compared to 300 (yes, just 300!) in the United States.

This quasi private, quasi State-owned model combined with differences in government structure gives China the ability to sustain near-term pain for long-term gain. As suggested earlier, China sees winning in AI and 5G as essential to its future. And China’s leadership is utilizing its broad influence to pursue its goal. For example, China is the largest shareholder in the country’s three largest telecommunications companies. And unlike American companies – who have to spend tens of billions of dollars to buy wireless spectrum – China simply “allocates” it for a nominal fee. China also appears to have significant influence over private enterprises and together with State-owned outfits it is able to push its long-term vision and strategy. Such a setup is harder to compete against, given China’s now significant scale and financial wherewithal.

Stepping back, technology leadership is inextricably linked to economic and national security. And the race to lead in next generation technologies is just getting hotter – hundreds of billions of dollars, if not trillions in value generation is at stake. From that perspective, China does indeed need to be challenged on its business practices and provide a level-playing field for foreign companies. In a recent national address, President Xi asked the country to prepare for the “new Long March” – evoking a historical event that featured Mao Zedong’s strategic retreat during a war that eventually brought his party to power 15 years later. This is suggestive of room for a deal, but reaffirms the long-term battle at hand.

Near-term, the path these negotiations take will likely dictate business and financial market behavior. Signs of turmoil are already apparent: economic data points in China point to a material slowdown and market selloffs have been accompanied with increased volatility. A lingering trade war could exacerbate business and market conditions as new trade alliances are pursued and businesses confront the re-architecting of supply chains that have been built over decades – slowing trade and stalling investment decisions. Higher tariffs in the meantime will be passed on to consumers, ultimately impacting economic growth. And market premiums may shrink as (a sizable) potential buyer of companies is walled off. Interesting times may be right ahead of us.

One tweet could change the status quo in a heartbeat, however!